Definition of an ESOP and ESOP Basics PowerPoint

To View ESOP PowerPoint please click here: ESOP 101 Basic PowerPoint

Definition of an ESOP

Technically an ESOP is a tax qualified defined contribution benefit plan. Functionally ESOPs are a very flexible financial and equity incentive instrument that uses corporate tax-deductible or “tax-free” dollars to achieve a variety of individual and corporate objectives, including shareholder liquidity, perpetuation, raising working capital, and charitable giving

An ESOP is unlike any other employee benefit plan in that the ESOP Trust, or ESOT, is designed to hold primarily stock of the sponsoring employer.

In its simplest form a company establishes a trust to which the company contributes stock or cash to purchase stock. The stock is then allocated out to employees’ individual accounts within the trust. When cash is contributed it is used to purchase stock from shareholders and then allocated out to individual employee accounts.

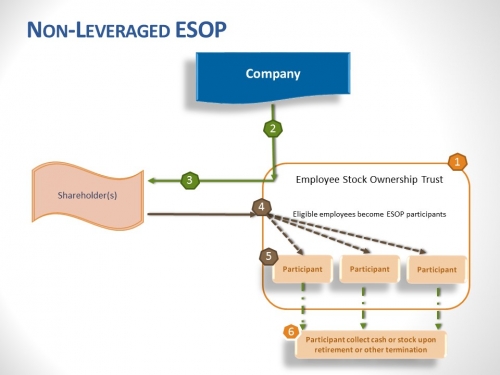

The Non-Leveraged ESOP

- Company sets up an ESOP Trust.

- Company makes annual tax deductible contributions in cash or stock to the ESOP trust.

- Cash is used to buy stock from current shareholders.

- Shares are allocated to the accounts of eligible employees within the ESOP, typically based on salary.

- ESOP holds stock for participants and annually notifies them of how much stock is in their account and the value of the stock in their account.

- Employees collect stock or cash, according to a vesting schedule, when they retire or otherwise leave the company.

The Leveraged ESOP – Seller Note

In the Seller leverage ESOP the, the Employee Stock Onwership Trust (“ESOT”) purchase shares from the seller with a promisory note and then repays the debt with the contributions contributed by the sponsoring corporation.

- ESOP buys stock from existing shareholders with a note.

- Company makes annual tax-deductible contributions to ESOP.

- The ESOP uses cash to repay seller debt.

- Shares are released from suspense account and allocated each year as ESOP repays sellers with contributions.

- The ESOP holds stock for participants and annually notifies them of how much stock is in their account and the value of the stock in their account.

- Employees receive stock or cash when they retire or leave (vesting applies).

The Leveraged ESOP – Bank and Seller Note

In the leverage ESOP the, the Employee Stock Onwership Trust (“ESOT”) borrows the cash to purchase shares then repays the debt with the contributions contributed by the sponsoring corporation.

For example

$10M Value

$5M Bank debt

$5M Seller Notes

- Bank lends $5M to company.

- Company lends $5M to ESOP.

- ESOP buys $10M of stock from existing shareholders.

- Shares are held in suspense account.

- Company makes annual tax-deductible contributions to ESOP to repay seller and bank debt.

- Shares are released from suspense account and allocated each year as ESOP repays company loans.

- The ESOP then repays company, who then repays the bank and sellers.

- The ESOP holds stock for participants and annually notifies them of how much stock is in their account and the value of the stock in their account.

- Employees receive stock or cash when they retire or leave (vesting applies).